- Everything You Need to Know about 1031 Exchanges!

So let\'s say you\'ve got yourself a rental property and you\'ve worked hard to get rents up and keep expenses low. The property is profitable and you are looking ... Watch Now

Watch Now

- Like-Kind Exchange Reporting

This lecture reviews the rules governing like kind exchanges. Topics Covered * The types of property that qualify for like-kind exchange treatment * Time frame ... Watch Now

Watch Now

- Selling Rental Property and Taxes (Investment Property Depreciation Recapture?)

Find out how selling a rental property will affect your taxes. Is it considered an Investment Property and how will capital gains or 1031 exchange come into play? Watch Now

Watch Now

- Paying the IRS when flipping real estate with the 1099-s quick and easy!!!

Just a short video on how to pay tax on the money MADE when flipping a house. If your reinvesting or it\'s your own house other rules come into play. Watch Now

Watch Now

- 1031 Exchange - Real Estate Investing Using Delayed 1031 Exchanges - REIClub.com

http://www.REIClub.com The Pros and Cons of Delayed 1031 Exchanges For Real Estate Investors. Here\'s A Video Explaining A Delayed 1031 Exchange. Watch Now

Watch Now

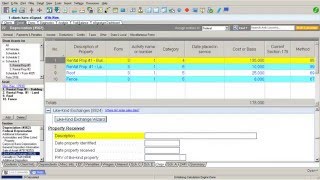

- Lacerte Like Kind Exchange Wizard

A demonstration of the Like Kind Exchange wizard in the Lacerte tax program. Watch Now

Watch Now

- Basic Session 18 - Sale of Home / Installment Sales/ Like Kind Exchanges - 2012 Tax Law

This session covers the following topics: Selling Your Home Recapture of Depreciation Installment Sale Income Like Kind Exchanges Preparation of Forms 5405 ... Watch Now

Watch Now

- In a Tax-Deferred Exchange, Can I Exchange One Property For Multiple Properties?

Tune in this month as owner of Equity Advantage, David Moore covers the questions - In a tax-deferred exchange, can I exchange one property for multiple ... Watch Now

Watch Now

- Statewide form 22ef Part one

Legal Hotline Lawyer Annie Fitzsimmons walks us through her favorite form, Statewide Form 22EF, the Evidence of Funds form. This video talks about the first ... Watch Now

Watch Now

- Tax Treatment of Sale of Rental Property

Checkout my business channel video: Calculating Gain/Loss on Sale of Your Property https://www.youtube.com/watch?v=3VEDxYtKHM8. Watch Now

Watch Now

- Flipping Houses Taxes | What tax do you pay when you flip a home?

Flipping Houses Taxes - http://www.reimaverick.com/flipping-houses/flipping-houses-taxes/ Flipping Houses Taxes | Tax Consequences Real estate investors ... Watch Now

Watch Now

- Passive Activity Loss & At-Risk Limits

A passive activity as a business activity in which a taxpayer is deemed not to actively participate. Losses sustained in the operation of a passive activity may be ... Watch Now

Watch Now

- STOP! What you NEED to know about IRS form-8949 for crypto

IRS #TAXES #CRYPTO Squaaaddd! Whats up Bitsquad, you NEED to watch this video to find out why you should be careful with form 8949 for crypto currency ... Watch Now

Watch Now

- IRS Capital Gains and Losses/Schedule D and Form 8949

IRS Capital gains and losses, IRS Form Schedule D, IRS Form 8949, Medicare Tax (Net Investment Income Tax), tax appeal.168 audiotaxhelp.com, IRS tax help ... Watch Now

Watch Now

- 1031 Like Kind Exchange Simultaneously

A 1031 like kind exchange can take many forms. One form is a simultaneous exchange. Find out how simple it is. Emunah Capital 786-592-2476 ... Watch Now

Watch Now

- Defer Taxes: Why EVERY Airbnb Host Should Do 1031 Exchanges!

Wednesday, June 19, 2019

1031 Exchange Forms

Subscribe to:

Post Comments (Atom)

-

ADAN EVA Y EL GORILLA //EL GORILLA MAS MALO DE TODOS../ Walkthrough perdon por el sonido se me paso por screencast pero bn disfruten.. EL J...

-

Clynton Dunn - Cape Flats Paradise.flv South African Comedian. Clynton\'s first attempt at a video of a parody of Collio\'s Gangste...

-

SIMBA AND NALA'S FIRST TIME ☆ Fanfiction Reading a Lion King fanfiction with Otter... starring me as Simba and Otter as Nala... Never. ...

No comments:

Post a Comment